Cybercrime- 7 tips to avoid financial fraud

Have you ever been scammed in the cyberspace or e-marketplace such as Carousell, eBay, or scam messages? Customers may try to scam sellers by not paying the agreed amount or send a fake proof of payment while sellers may send a different product than advertised. Have you ever heard about the ZeekRewards case — the alleged $600 million Cyber Ponzi scheme?

What is Financial Fraud?

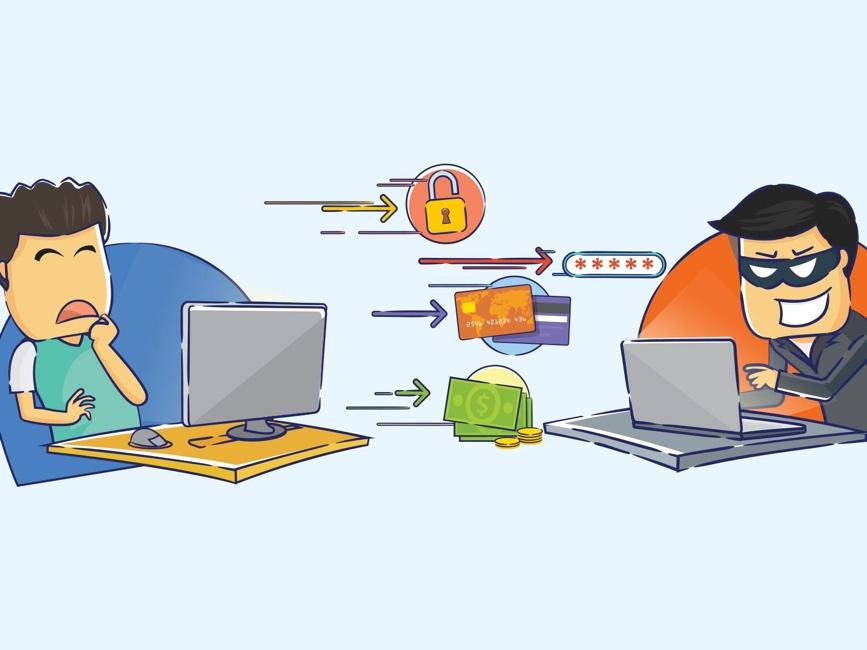

Fraud is a crime. Nowadays, all digital devices are connected to the internet. Fraud is an intentional act of deception often involving complicated financial transactions, commonly for personal gain purposes. Financial fraud can cause someone to lose their property, money, or other assets.

Understanding how to protect your savings and assets is vital. So, to shield yourself from financial harm, here are 7 tips that you should know.

1) Protect your personal information!

Keep all such information confidential and safe, and update your passwords and PIN numbers periodically. Do not keep all your passwords at the same place. Your financial providers such as banks and brokerages, or the police will never contact you to disclose your passwords and PIN numbers.

*Don’t disclose your personal information to anyone.

2) Online security

As technology advances and the world becomes more reliant on financial data for global interaction, financial fraud becomes easier to occur. The convenience of keeping your biometrics on your phone versus the risk of getting your information stolen are real. To ensure your security online, install trusted anti-virus and anti-malware softwares in all your digital devices. Use only trusted apps and pick apps that provide end to end encryption whenever possible.

*Don't use suspicious applications where encryption is vulnerable.

3) Be careful when online transferring money, Be aware of... phising websites.

"It should be safe and authenticity via bank transfer, how can that be a fraud?".

Does this sounds familiar? Fraudsters can use technology to make it their calls from legitimate business or organization to instruct a victim to transfer money online from a Phishing Website to meet their goals.

Before clicking it, please check and study the URL before you click it. If it appears as https://- it offers an extra layer of security and safe for data transfer and authenticity. We assume this is safe and safe to make a transaction. But we might still end up at a phishing website.

Phishing is a word statement from password + fishing. Phishing scams are a form of identity theft, where spam emails are sent out to entice the victims to update their banking credentials. For example, an e-mail titled "Latest Phishing email from LHDN" will be requesting taxpayers to submit tax refund request. LHDN does not send out any e-mail requesting customers to provide personal information or directing customer to bank website.

So how do we know? I will suggest to pick up a phone call to the related department and walk in to the branch office and talk to the officer directly. Be sure to verify their identity, especially when they are asking for your personal details and/or asking you to part with your money. Also, to avoid falling victim to these attacks, we can avoid handing over our personal info to them.

*Don't visit websites that don't have HTTPS encryption, especially when it comes to websites with sensitive personal information.

4) Be alert! Look out for scams

An Internet Scams study shows that the top three scams in Malaysia are 'work from home' fraud (30%); internet auction scams; (22%) and online dating scams (20%).

Let’s talk about the online dating scams. Scammers take advantage of people looking for romantic partners online. They play on emotional triggers to get victims to provide money, gifts or personal details. The popular scenarios include scammers nurturing a relationship to gain someone’s interest and trust, such as showering loving words to transform into committed romantic relationship.

Later, they may claim financial hardship due to an unfortunate run of bad luck such as a failed business to ask the victims to send them money for emergency financial help. There is no further personal banking account provided, they are always going to Western Union.

– Nigerian dating scam.

Sometimes the scammer will send you some large amount of money to your personal bank and make up a reason they can’t access to their personal bank account for some emergency funding. This is likely to be form as money laundry which is a criminal offence.

*Don't send money to someone you haven’t met in person."

*Do an image search of your admirer to determine who they say they are. You can use image search services such as https://www.tineye.com/

*If you agree to meet a prospective romantic partner personally, do share with your family and close friends too about the agenda of meeting. Scamwatch is strongly recommended!

*Don't travel overseas to meet someone you have never met before.

5) Too good to be true- Don’t be tempted by high returns

Why is greed the root of all troubles? Fraudsters prey on the greed of investors who are attracted by aggressive and quick returns! They always promise of a high return for your investment is often too good to be true. In most investment fraud cases, investment scams involving pyramid and Ponzi schemes with guaranteed percentage of high returns are to tempt investors to make bad decisions.

For example, ZeekRewards case — the alleged $600 million Cyber Ponzi scheme! This zeekler penny auction scheme promised high returns to all its investors, but they are not licensed intermediaries such as banks, brokerages and financial planners!

*Do know your risk management.

*Be realistic and know that there is no FREE lunch in this world!

*Ensure you are dealing with licensed brokerage and financial planner.

6) Don't rush into making urgent decision for any impulsive act.

Scammers can steal pictures of your loved ones from social media to trick you into thinking a loved one is in trouble.They ask you to send money immediately to resolve the emergency issue. To make their story seem real, they may claim to be an authority figure, like a lawyer or police officer; they may have obtain some facts about your loved one when they perform this.

Calm down!!It can be fake to lead you in scam!! So what can you do? Check it out before you act.

*Do look up that friend or family’s phone number yourself. Call them or another family member to see what’s happening. Even if the person who contacted you told you not to.

*Don’t pay, wire money, send a check overnight.

7) Always validate all the original or legal document copy before proceeding

Do you need a lawyer when you buy or sell your house? Don’t save legal fee. Buying or selling your home is one of the most significant financial event(s) in your life. Every transaction should include the creation of a real estate contract between the buyers and sellers. Homeowners often think that it is easy to receive payment from seller, but that can be a fraud case by the end of the closing deal.

*Don't always be to hesitant when it comes to legal fees.